Current Climate: Decoding Therapeutics Financing

Following on from Creating a Richer National R&D Pipeline with Professor Chris Molloy, in this blog, Tim Newton investigates the trends and challenges that shaped therapeutics financing from 2020 to mid-2023.

By Dr Tim Newton

23 May 2024

Current Climate: Decoding Therapeutics Financing

With over 22 years of experience in strategy, business planning, market insight and transformation across various industries – including life sciences, retail banking and management consulting. Tim Newton uses this broad experience to support strategic initiatives through insight and analysis of the UK and Global drug discovery ecosystem.

Following on from Creating a Richer National R&D Pipeline with Professor Chris Molloy, in this blog, Tim investigates the trends and challenges that shaped therapeutics financing from 2020 to mid-2023. This thorough, systematic analysis is intended to help policymakers and small to medium enterprises (SMEs) at all stages of development plan for a more robust future.

Current Context

Today’s economic landscape is informed by recent significant events, including Brexit, the global pandemic, the war in Ukraine and the tensions affecting the Middle East. In common with businesses and economies worldwide, these seismic events have impacted funding access and created inflationary pressures for UK therapeutics SMEs. Companies have been affected in differing ways and to differing extents, depending on the individual SME’s nature and stage of development or evolution.

Globally, venture capital funding to pharma companies experienced a significant increase from 2019 to a peak in 2021 – reflecting positive investor sentiment and the low base rate environment. The subsequent decline in financing aligned with rising inflation and base rates and a shift in investor sentiment.

We undertook an analysis to gain a more targeted picture focusing on UK therapeutics SMEs to understand how they have fared over this period.

Trends and Challenges Highlighted

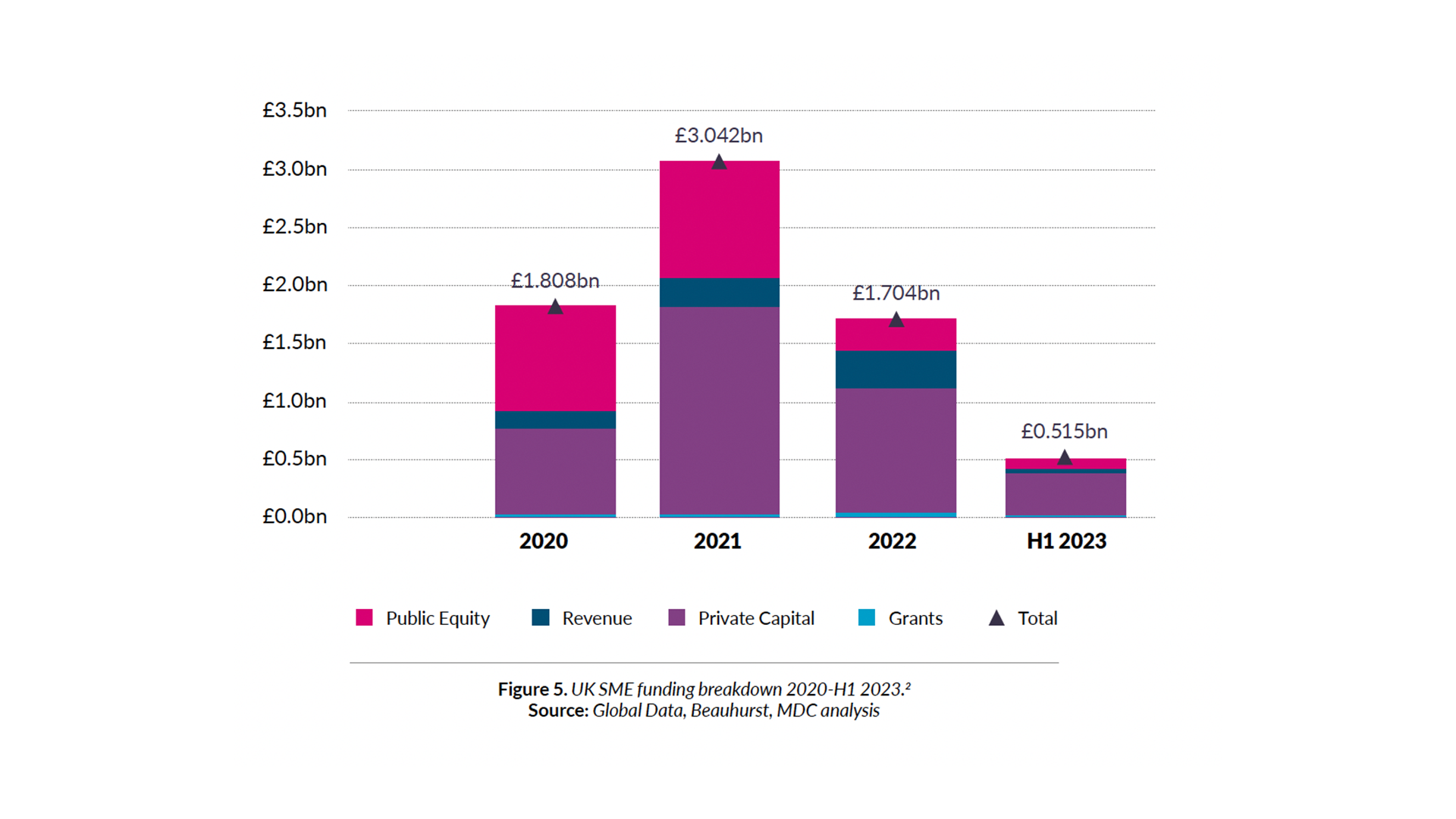

The figure below shows the aggregated view of financing for UK Therapeutic SMEs. In 2020, the main drivers of financing were private capital and public equity – with an almost equal split between the two. By 2021, the private side had increased to nearly 60% of all funding. A year later, the downturn saw significant reductions, particularly in public equity funding. The downward trend in financing persisted into the first half of 2023, with the financing dominated by private capital and public equity subdued.

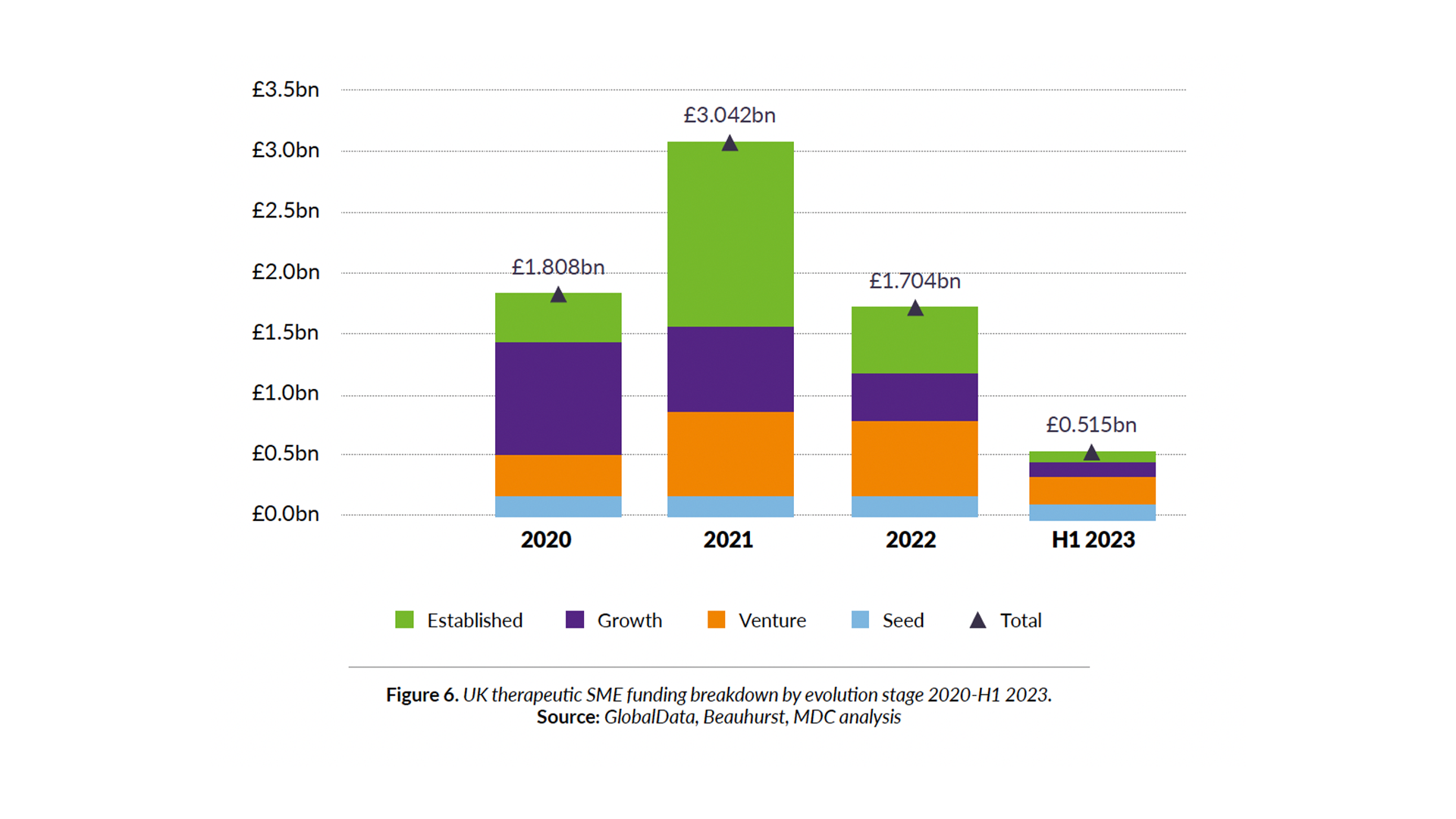

But aggregated figures don’t necessarily reveal the differing ways the companies have experienced economic challenges. To gain that picture, we used our data to construct a high-level segmentation model, to discover the realities of how SMEs at different evolutionary stages have been impacted. The model categorises companies by four life stages – ‘seed’, ‘venture’, ‘growth’ and ‘established’.

Seed SMEs

Over half of UK therapeutic SMEs can be categorised as seed – typically young, high-risk entities that rely on private capital and grants for their operation. They will usually have small workforces, limited cash, and low debt.

Venture SMEs

Venture SMEs comprise roughly 25% of the UK therapeutic sector. These will probably be older than seed and will have secured multiple fundraisings. Their pipeline will be more developed, they will have higher cash reserves, and they may have access to public equity.

Growth SMEs

Growth companies are usually older than seed and venture SMEs, constituting around 10% of the sector. They employ more people, have raised more finance of higher value and enjoy higher cash reserves. They may have formed strategic alliances, including licensing agreements or partnerships.

Established SMEs

5% of the sector can be defined as established. They are, by definition, older and larger than the previous three categories, with multiple fund raises behind them. Their cash reserves are usually higher, and they will have multiple assets – including in the clinic. These companies will have also formed strategic alliances such a licensing deals or partnerships.

The Financing Mix per Grouping

Seed SMEs mostly rely on private finance, and its availability reduced between 2020 and 2022. Add the effects of inflation, falling numbers of deals and the fact that most seed companies did not benefit from 2021’s surge in financing, and it is clear that this has been a challenging period for this group of companies.

For Venture SMEs, over 85% of financing in 2020/22 was private. Public capital took an emerging role through the more buoyant background of 2021. Venture financing increased during 2020/22 and has outpaced inflation.

In growth SMEs, there has been a shift in both the value and mix of financing over the period, with public equity reducing dramatically from its 2020 dominance. A constrained environment with inflationary pressures has challenged this category.

Established companies tend to depend on public equity and, more recently, on turnover (e.g. from milestone payments). In 2020, public equity constituted over 70% of financing. The following buoyant period saw a pulse of private capital before falling away in 2022. Inflation and challenging access to public finance have impacted these SMEs.

The future?

There are signs that inflation continues to trend downward, with positive implications for company financing; however, uncertainty and headwinds remain with stretched SMEs still inhabiting a challenging landscape. Nevertheless, we’re seeing increased funding activity, promising better times ahead.

While predicting the future is fraught with pitfalls, the insights MDC analysis provides can help inform policymakers and contribute to creating a more robust architecture for our sector going forward.

Methods

The data is a mix of publicly available and paid-for data sources. It examines UK-headquartered SMEs with at least one active, innovative drug asset in their pipeline.

Our focus concentrates on over 350 companies and brings together data from sources such as Beauhurst, GlobalData, Companies House, and company websites.

Crucially, an independent third party was invited to validate our data to ensure their integrity and reliability.