Michael Salako, Investment Director,

Start Codon

28 June 2024

Start Codon is a venture capital investor and venture builder based in Cambridge

Venture capital is essentially a pool of money made available by investors – known as limited partners – to be managed and applied by general partners for businesses that require funds to achieve growth.

From the investor’s perspective, the aim of this process is to increase their capital. Their original investment and the additional money that grows from a business building value over a set period is subsequently returned to them, plus a premium which reflects the fact that their money has been locked-in over the investment term.

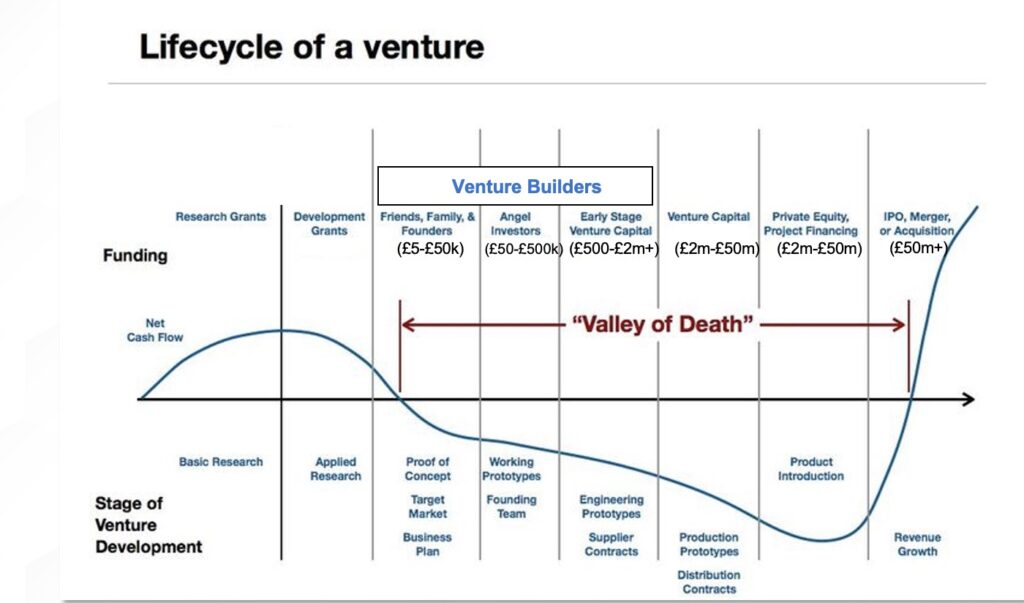

The chart traces how net cash flow is typically affected as a business progresses an innovation from early research stage through to launch and eventual revenue growth. Venture capital is usually applied to help bridge the early-stage gap – the downward dip ‘valley of death’ in the cash flow path shown here.

People new to the world of raising venture capital tend to imagine themselves presenting an impressive pitch deck to potential investors face-to-face, or through an online meeting. In reality this rarely happens.

Investors are extremely busy people, and any pitch you want to make will have to be sent to the investor upfront and be pitch-ready. This means the pitch deck must be able to stand for itself, without a presenter to tell the story or to fill in any gaps. Without a narrator, your pitch deck needs to present clear, credible information that covers all the important bases.

To get a pitch to the right person and to gain their attention means doing research into the investor or investors you target. Due diligence will reveal what an investor company looks for in opportunities. Most will have a publicly viewable portfolio of past and existing ventures they support, so it is helpful to check for businesses that are comparable to your own in a given investor’s portfolio.

A venture capital provider may have a life sciences focus, but only an interest in one specific field, so it is important to check that your opportunity aligns with their preferred sector.

It could be that the investor already supports a business in an area where you would constitute a direct competitor, so they may be unlikely to consider investing in your business. Equally, if your idea offers a strong, advantageous differentiation, they might be tempted to favour it.

It is always worth exploring your contacts in spaces such as LinkedIn and other social networks, to see if someone you know is in someway connected with the investor you wish to attract. Creating an ‘in’ via a mutual contact who facilitates a ‘warm’ introduction is far more likely to get your pitch seen than a cold call.

To be pitch-ready, a pitch should always be clear and easily digested in explaining your proposition.

Of course this is an obvious fact, but one that is very easy to lose sight of as you and your team delve into the detail, the data and the ‘should we add x?’ debates.

As a general guide, your pitch could unfold as follows:

1. The title slide – this should be as engaging as possible

2. Executive summary and your ‘ask’ – investors are almost always time-poor, so spelling out exactly what the opportunity is at this initial point is essential in gaining their interest straight away

3. Problem – make this description clear and concise

4. Solution/technology – again, this should be very ‘to-the-point’. Founders are often guilty of describing plenty of science and exciting technology in their solution, which can sometimes come across as searching for a challengea solution looking for a problem to solve. The investor simply wants to understand and accept the problem, and be convinced that you have a unique way to solve it

5. Product/Platform – A simple summary of your product/platform/solution and why the time is right to invest in this idea. Perhaps it’s based on a new scientific development or an emerging challenge? There needs to be a clear, pressing need.

6. Team – this can be a very persuasive slide (one you may want to feature earlier in the presentation). Your people with their relevant knowledge and experience are a unique asset in supporting your proposition, and a crucial reassurance for the investor that the talent is equal to delivering your solution

7. Market – it is essential to demonstrate a strong understanding of your target market – its size, whether and how you need to segment it, whether you are aiming for a certain demographic or geographic area. Backing your claims and strategy with reliable data is key to your credibility here

8. Competition – demonstrate that you have a realistic, 360° knowledge of your potential competitors. Investors don’t necessarily need you to be the first or only player in the market; what matters is seeing that their input can help you to become the best in that space

An interested investor will subsequently study the market exhaustively, so any omissions made in your pitch could ring alarm bells at a later stage.

It is important to stress that listing all direct and indirect competitors (perhaps as an appendix slide) shows you have a confident, realistic business outlook. The presence of competitors signals that you are aiming at a buoyant market – investors simply want to know you have a viable differentiation to offer.

9. Business model – how you plan to progress your idea through to generating revenue

10. Financials and key metrics

11. Fundraising amount, use and key milestones over 18 months – detail the amount of capital you are seeking, and how it will be used to support the business plan through early-stage period

12. ‘Thank you’ slide – the final element of your pitch should reiterate who you are and your top-line ambition. Your final slide should include a one-liner to summarise your ambition, plus a call to action and your contact information e.g. ‘Get in touch to find out more’.

As a general point, it can be useful to imagine that if someone only skims through your deck’s slide headings, they still gain a good sense of your compelling opportunity. Therefore headings should ideally summarise each slide’s content, rather than simply state ‘Problem’, ‘Solution’, for example, this will ensure you are pitch-ready.

Being pitch-ready means more than having your deck finalised to send out into the world, as important as that is. It is also useful to be ready to pitch in what can be unexpected circumstances – a social interaction, a chance meeting, networking event or indeed, an elevator, could be where your investment journey starts.

Be ready with a 30 second ‘elevator pitch’ of your proposition and be prepared to secure contacts – a simple business card is useful, as is connecting on LinkedIn or a similar platform.

Michael Salako, Investment Director, Start Codon