UK Life Sciences – The Future is Bright, Creating a Richer National R&D Pipeline

There are signs of recovery, but one that is in its very earliest stages. There is evidence of capital beginning to flow. However, not to all parts of our sector.

By Professor Chris Molloy, CEO at Medicines Discovery Catapult.

22 May 2024

Pressures Remain

Throughout this blog, I will explore the good news stories and reasons for optimism, such as the Mansion House Compact and spin-out review. However, the current situation remains challenging for most in the sector due to sustained cost pressures and reduced funding streams. Medicines Discovery Catapult’s research shows that SME therapeutic companies are particularly hard-hit. This series of blogs explores the challenges and opportunities to create a richer national R&D pipeline.

The Recovery

As I write this in spring 2024, there are signs of recovery, but one that is in its very earliest stages. There is evidence of capital beginning to flow. However, not to all parts of our sector – for example, funders are still inclined to advise pre-clinical organisations to ‘extend their runways’ in the meantime.

The ‘Mansion House Compact’promises future flows of pension fund investment, and with it comes the need to create absorptive capacity for those funds in our sector. The spin-out review in November 2023 recommended how best to build national pipelines. Overall, we need to examine how we adapt companies to become ‘fit-to-fund’ and able to access growth from that fitness.

Patients’ Futures Made Brighter by Biotech

The UK drug discovery sector has made excellent use of strong funding over the past five years. Today, the sector is generating more innovation than ever. We see assets have diversified to address a broader range of health conditions. Even more, great UK science has been drawn through the pipeline to the clinic and patients.

The period is also characterised by the development of more complex medicines, to drive the large pharma pipelines of the future. Yet, in leveraging the UK’s world-leading science towards new treatments so effectively, certain issues have come to the fore. There are now fewer skilled people in the recruitment pool, less physical space for our sector, and less money to propel innovation.

It has been a Hard Pre-Clinical Winter

Over the past year or so, funding has started to fall away, and confidence has faltered. The global economic downturn affects us all, although our sector has performed reasonably well compared with other high-tech industries. Inflation has increased costs for organisations across the board and caused wide-ranging problems. Venture funding has been greatly impacted by high interest rates, with the SME pre-clinical community feeling the effects most severely.

Read our blog, Decoding Therapeutic Financing, with MDC Senior Market Analyst Dr Tim Newton as we investigate trends in pre-seed and seed difficulties for the pre-clinical cohort.

The National SME Pipeline

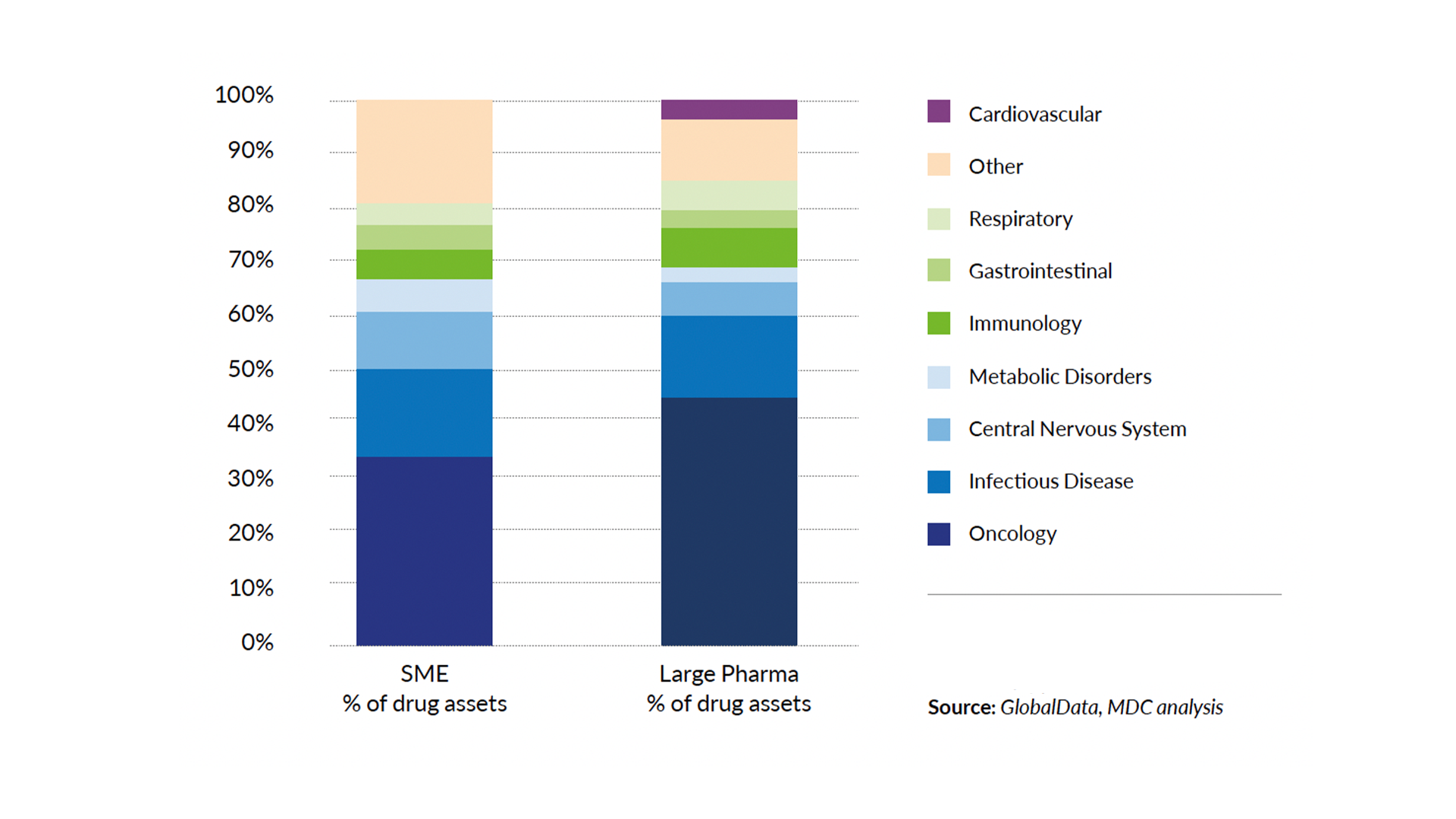

The spread of assets flowing through SMEs grouped by therapy area reveals some distinct ‘good news’ stories. For example, there is a greater spread of therapeutic areas across the national portfolio and assets flowing through SMEs are up 30% compared to 2019. Some new initiatives are driving this diversity, and more assets are flowing through the pipeline toward patients.

A diverse future is on the horizon. For example, more complex medicines are coming through SMEs’ research to feed into the large pharma company community. MDC’s State of the Discovery Nation 2021 report highlights the need to build the UK as an epicentre for more complex targeted medicines. This underlines that this diversity-focus offers a dynamic future for our sector.

Skills and Space

We have great life science talent in the UK; our skilled people have been deployed well, but we need more. We need to interrogate the underlying issues to direct the most effective interventions.

The lack of suitable, affordable premises for our sector remains a serious challenge. A new Department for Science, Innovation and Technology (DSIT) ‘Innovation Map’ shows the densities of life sciences sites across the UK – where there is a higher density and those areas where there are opportunities for growth.

The UK Spin-out Review

The fundamentals of our sector are sound. Good people, a propensity for invention, spin-outs driving innovation, the proven ability to move through de-risking to adoption – these factors underpin UK science.

The UK Spin-out Review has 11 enabling recommendations that are instrumental to create a transparent, visible national pipeline. This, in turn, will help give investors access to opportunities across our regions and support companies in becoming fit-to-fund and achieving growth.

Fit-to-Fund, Fit to Grow

The promise of more pension fund resources available over the coming years will be critical. We must start now to make ourselves fit-to-fund, centred around some of the Spin-out Review’s recommendations, but existing facilities also have significant parts to play. The UK has a wealth of public and private organisations engaged in Catapult, incubator, and accelerator roles, and these should be harnessed, nurtured and supported.

These groups need to be connected to build a national visible pipeline with critical mass for investors. It is crucial to devote funding and attention to nurturing next-generation leaders across our sector.

Whilst the landscape is undeniably challenging in the short term, we have what it takes to excel – putting assets into an ever-growing national pipeline of diverse, more complex medicines that meet patient needs more fully than ever before.